The Prime Minister Youth Loan Program offers a fantastic opportunity for young people in Pakistan who want to start or expand their businesses. In September 2025, the application process will be simplified, enabling applicants to apply easily online. This initiative aims to reduce unemployment, foster entrepreneurship, and empower young people to take their business ideas forward. The program provides financial support with flexible repayment options and low-interest rates. Through this scheme, the government seeks to nurture young talent, helping them create jobs, boost local economies, and improve Pakistan’s business landscape.

Prime Minister Youth Loan Program Overview

The Prime Minister Youth Loan Program is an initiative aimed at empowering young, educated, and skilled individuals by offering loans on easy terms. The loan covers a variety of sectors, including agriculture, IT, retail, and services. This financial support is designed to reduce unemployment and encourage business ventures across Pakistan. With minimal paperwork and quick approval, the program helps young entrepreneurs take the first step in building or growing their businesses. It provides an excellent opportunity for youth to pursue their entrepreneurial dreams and contribute to economic growth in the country.

Key Features of the Prime Minister Youth Loan Scheme

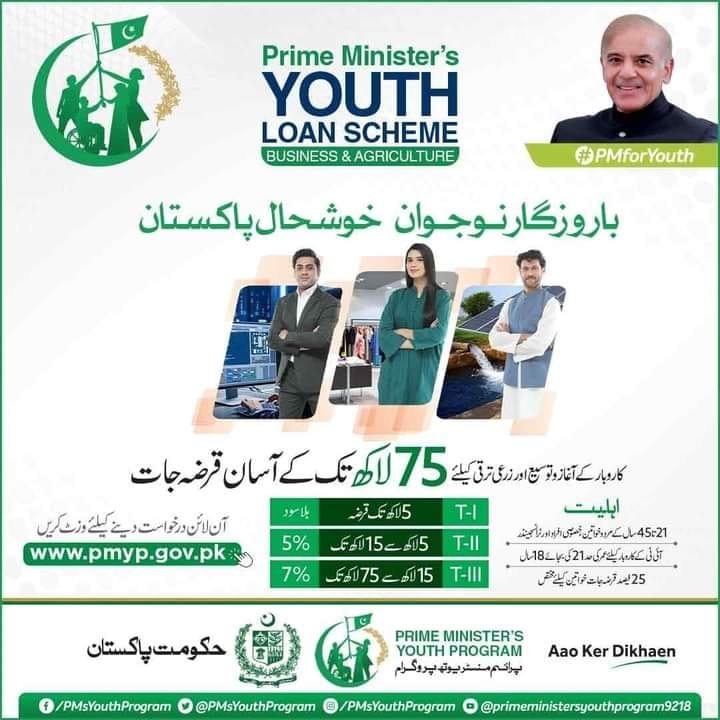

| Key Feature | Details |

|---|---|

| Loan Amount | Up to PKR 5 million |

| Repayment Period | Flexible, up to 8 years |

| Interest Rate | Low compared to commercial loans |

| Target Audience | Youth, including women entrepreneurs |

These key features make the loan program accessible and affordable, enabling youth to start and expand their businesses effectively. The inclusion of women entrepreneurs and the low-interest rate sets this scheme apart from other financial initiatives.

Eligibility Criteria for Prime Minister Youth Loan

To be eligible for the Prime Minister Youth Loan Program, applicants must meet the following criteria:

- Age Limit: Applicants must be aged between 21 and 45 years (for IT-related businesses, the minimum age is 18).

- Pakistani Citizenship: The applicant must be a Pakistani citizen and possess a valid CNIC.

- Business Plan: A clear and feasible business plan is essential for loan approval.

- Inclusivity: Both male and female applicants are encouraged to apply.

These criteria ensure that the loan is granted to those with a viable business idea and the potential to succeed.

How to Apply Online for the Prime Minister Youth Loan

Applying for the Prime Minister Youth Loan Program is simple and can be done online. Here’s how to apply:

- Step 1: Visit the Official Portal

Go to the official Prime Minister Youth Loan Program website and click on the “Apply Online” option to begin your application. - Step 2: Fill the Application Form

Provide all the necessary information, including your CNIC, business plan details, and financial requirements. - Step 3: Upload Required Documents

Attach important documents such as your CNIC, business proposal, educational certificates, and bank account details. - Step 4: Submit Your Application

After reviewing your information, submit your application. You will receive a tracking number to monitor the status of your application.

This process ensures that applying for the loan is quick and accessible for everyone, even those who may not have experience with complex financial procedures.

Benefits of the Prime Minister Youth Loan Program

The Prime Minister Youth Loan Program offers several advantages for young entrepreneurs:

- Low-Interest Loans: The loan comes with a much lower interest rate than commercial loans, making it more affordable for new businesses.

- Flexible Repayment Period: The loan can be repaid over a period of up to 8 years, reducing the financial burden on borrowers.

- Startup and Expansion Support: The loan can be used for both new business startups and expansion of existing ventures.

- Women Empowerment: The program reserves a special quota for women entrepreneurs, encouraging them to apply and succeed.

These benefits make the program an ideal option for young people in Pakistan who want to turn their business ideas into reality.

Read More:Benazir Hunarmand Program 2025: Online Registration Portal Open for Free Skill Training

Conclusion

The Prime Minister Youth Loan Program offers a great opportunity for young individuals in Pakistan to start or grow their businesses. The application process is simple, and the loan offers low-interest rates, flexible repayment options, and various benefits aimed at supporting young entrepreneurs. By applying for this loan, you can receive the necessary financial support to build your business and contribute to economic growth. In this article, we have shared the key details about the loan program, including eligibility, benefits, and how to apply. If you’re a young entrepreneur, this is your chance to bring your business ideas to life.

For more information and to apply online, visit the official website of the Prime Minister Youth Loan Program.

FAQ Section

1. What is the maximum loan amount under the Prime Minister Youth Loan Scheme?

The maximum loan amount available under the scheme is PKR 5 million, depending on the applicant’s business plan and financial needs.

2. Who is eligible to apply for the Prime Minister Youth Loan?

Pakistani citizens between the ages of 21 and 45 years (with a minimum age of 18 for IT-related businesses) are eligible to apply.

3. Can the loan be used to expand an existing business?

Yes, the loan can be used to either start a new business or to expand an existing one, depending on the applicant’s needs.

4. How long does it take to process the application?

The application process is efficient, and you will be updated regularly on your application status. Processing times may vary, but updates are typically provided within a short period.